How to do bookkeeping for small businesses: A step-by-step guide

With an accurate record of all transactions, you can easily discover any discrepancies between financial statements and what’s been recorded. This will allow you to quickly catch any errors that could become an issue down the road. Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions.

Bookkeeping Basics: How to Balance the Books

If you bill a customer today, those dollars don’t enter your ledger until the money hits your bank account. Mixing together personal and business expenses in the same account can also result in unnecessary stress when you need to file taxes or do your bookkeeping. It could mean a business expense gets lost in your personal account and you miss out on an important deduction. Income statements feature the business expenses and revenue by different categorized profit centers. When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate. Remember that each transaction is assigned to a specific account that is later posted to the general ledger.

- Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year.

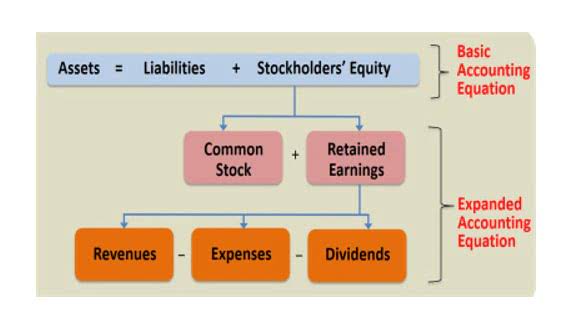

- Remember that assets are what your company owns, and liabilities are what it owes.

- Detailed reports and statements that show past, present and future projected financial statements help to curb doubt and shed light on your potential success rate (with the new financing).

- As long as you automate tasks and pick the right bookkeeping system for your specific needs, you’ll have an easy time implementing all the advice above.

- You’re not actually making or losing any money—it’s just in a new place.

- With a budget, you are better equipped to plan for future expenses.

Do I have the time?

If you run a limited company or a limited liability partnership, and/or have a turnover of £300,000 per year, you must use the accrual method. Analyse the overall organization of your business records to figure out how accessible they are. Review the overall security of your business records and uncover areas for improvement.

EXPERIENCED AND EFFICIENT TAX PREPARATION IN NYS

When your small business is just starting out, trial balance you might do your own bookkeeping. You can find good resources online that can help you get started and provide tips to ensure you are doing it correctly. However, bookkeeping can be time-consuming, which is something to consider. Whether you are an independent contractor or a multinational corporation, bookkeeping is important to you. With a budget, you are better equipped to plan for future expenses.

- For example, a loan would go under liabilities since you’ll have to pay it back later.

- Accurate bookkeeping is vital to filing tax returns and having the financial insights to make sound business decisions.

- For most entrepreneurs, it’s wise to hire a bookkeeper from the very beginning.

- Security should be your number one priority when setting up a bookkeeping system.

- It’s the meticulous art of recording financial transactions that a business makes.

Bookkeeping Tools and Software

Tasks, such as establishing a budget, planning for the next fiscal year and preparing for tax time, are easier when financial records are accurate. Bookkeeping is just one facet of doing business and keeping accurate financial records. With well-managed bookkeeping, your business can closely monitor its financial capabilities and journey toward heightened profits, breakthrough growth, and deserved success. When you think of bookkeeping, you may think it’s all just numbers and spreadsheets. Bookkeeping is the meticulous art of How to Meet Your Bookkeeping Needs recording all financial transactions a business makes.

types of bookkeeping for small businesses

You can expect most bookkeepers to maintain the general ledger and accounts while the accountant https://www.bookstime.com/blog/cares-act-step-by-step-guide-for-small-businesses is there to create and interpret more complex financial statements. A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly.

Tips for Small Business Bookkeeping

For a comprehensive and compliant overview of your financial situation, you’re more likely to require the use of the double-entry bookkeeping system. Bookkeeping is the process of keeping track of the money your business makes and spends – and crucially, ensuring that marries up with how much cash you’ve got in the bank. This means you do not legally have to maintain detailed financial records and therefore, you may decide that you don’t need the support of a bookkeeper.

- Since bookkeeping is a more straightforward process than accounting, it is something that many people can (and do) opt to take care of themselves.

- Stay up to date with your transactions, categorise your income and expenses and easily create and pay invoices.

- Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

- A separate bank account is the first step in distinguishing between business and personal finances.

Setting and sticking to good bookkeeping habits will help you feel in control of your business finances and save you time in the long run. When you set up your bookkeeping system it should make sense to both you and your bookkeeper/accountant alike. If you’re a small business owner, you may hold the only investment in the firm. But in larger businesses, third parties may have investments too which you’ll need to take into consideration when calculating equity.